Episode 62 / November 30, 2018

Listen now:

Welcome to The Redirect Podcast, where the BlackTruck team shares recent insights and takeaways from the world of search marketing.

In this week’s episode:

- An exploration of the top local search ranking factors for 2018. The annual survey published by the team over at Moz has us discussing what are the most critical elements to focus on in your local search strategy, defining what many of them are and what it means for your brand (begins at 1:48).

- Google has expanded its local pack search results for hotels in ways that will make it even more difficult for small businesses and CVBs to compete (begins at 14:35).

- Plus, an exploration into online shopping behavior post Black Friday and Cyber Monday. The two major shopping days of the year have major retailers prepping months in advance, but when it comes down to it, how did users interact with ads, and what did this year say about average order values? (begins at 20:42).

We also mentioned a way to report scammers who contact you regarding Google My Business and are in violation of Google’s policies. You can check it out here: Google My Business Third Party Policy: Report a Violation.

Moz’s 2018 Local Search Ranking Factors Survey

The results of Moz’s 2018 Local Search Ranking Factors Survey were published just over a week ago (and also discussed in digest format on Moz’s Whiteboard Friday).

The survey results have noted “huge growth in Google My Business” in the last year, considering the major features that have been released in GMB since the 2017 survey:

- Google Posts made available to all GMB users

- Google Q&A

- Website builder

- Services

- Messaging

- Videos

- Videos in Google Posts

Google My Business signals were found to now make up 25% of the ranking factors breakdown for local pack/local finder for 2018 (they were 19% for this breakdown in 2017). Almost neck-and-neck with each other behind GMB signals are Links at 16%, Reviews at 15%, and On-page signals at 14%.

Along with the results of the survey, Darren Shaw shares a To-Do list for different areas discussed. Recommendations in the GMB world include using Google Posts (you can re-use social media content to engage searchers and target conversions via calls to action); and to fill out the Q&A with your own content and answer questions. (How often have you seen unanswered questions on a Google listing? Yikes.)

We wrote about Google Posts after they were announced in June 2017, and Q&A in August 2017. In addition to updating photos and videos on your listings, these are both seldom-used features that can differentiate you from competitors who aren’t using them. It seems these features still have not been adopted by many businesses.

Review signals have increased 17% over last year (over the last 3 years, they have increased 43%). The recommendations are not new, but still valuable:

- Get more reviews (give the direct link to leave a review to customers)

- Encourage use of your valuable keywords in the reviews

- Respond to reviews

Citation signals have decreased over 36% over the last few years, but that doesn’t mean they’re not still important.

As for the future of local search, it’s inevitable that Google will continue to capture searchers right on the results pages, as we’ve discussed here before in Episode 58—so you may see less traffic to your site from local search results. This gives all the more reason to claim and manage your listing; it’s also worthwhile for being able to track behavioral signals like searches for your brand name, calls to your business from the listing, engagement with your listing, etc. So get to it!

Google’s Hotel Local Pack Gets an Update

Here at BTM, we work with tourism boards, hotel and convention centers, and visitors bureaus—and the underlying goals of these companies. The goals come down to the best interests of the local hotels by getting people to come get a room in their city so they’ll spend money in the city—to get ”heads in beds.” The SEM professional’s quest is winning the “where to stay in xxx” game.

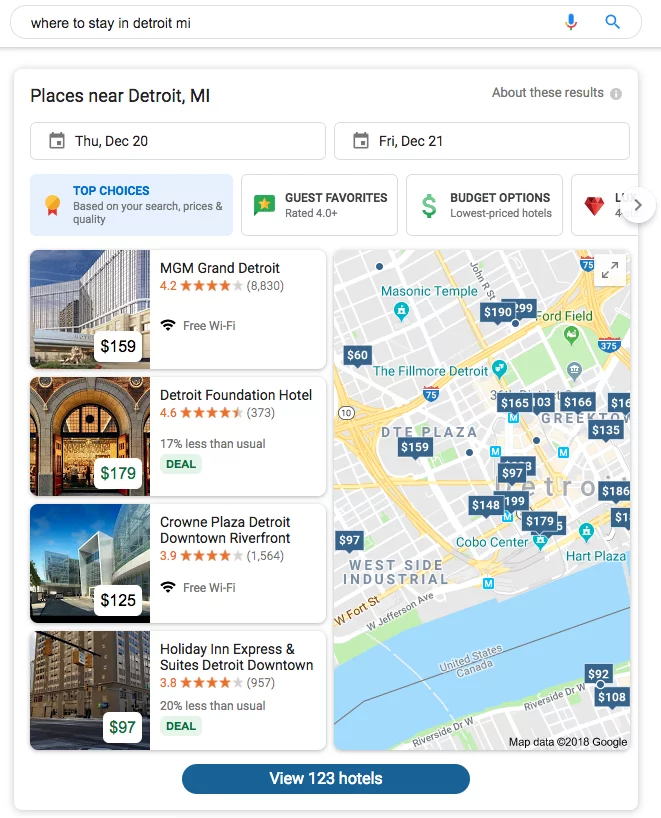

Well, there’s no easy path to achieve this when we’re competing against big brand hotel chains—and Google themselves. In a category that Google already made difficult to complete in, with their local packs they’ve now expanded the features available for searchers—notably, going from 3 listed businesses to 4. Additionally, there is now a carousel at the top of the local pack with popular search categories relating to budget, type, location, brand, etc. Here’s a screenshot of the new design:

This makes it easier for a user to never leave the local pack, and that much more difficult for a smaller business—even the search conglomerates like Kayak, etc, to be seen.

Read more from Search Engine Land.

Black Friday & Cyber Monday Shopping Results

Having just come off a big weekend of managing ads for a few clients in the B2C space with promos running pretty much from Thanksgiving through Cyber Monday, it’s fresh in our minds how shopping trends have shifted over the past year. What does it mean for conversions on ecommerce sites and brands that compete with big box retailers? When are those conversions happening throughout the day—not just clicks on ads, but orders on the site—and does it all mean in terms of average order value (AOV)?

From Search Engine Land: Cyber Monday dominated Black Friday in paid search spend, but AOV lagged. Check out the infographic—average order value was high for Thanksgiving and Black Friday, then shrank down for the weekend before ramping up for Cyber Monday. We saw similar results, but we actually saw AOV jump up on Saturday and Sunday compared to last year. Sales “crushed it” Thanksgiving through Sunday, then on Cyber Monday actually dwindled in comparison.

We saw that the big box retailers in the space were dominating. With their bigger budgets, we had to monitor spend pretty tightly. This is where really understanding shopper behavior comes in handy to develop a better ad schedule and avoid budget burn. (For example, $100 a day at $5 click can be eaten up pretty quickly! Do you really want to run ads from 5:00am to midnight?)

We saw something interesting in buying patterns: Lots of shoppers were loading up their shopping cart, and it would appear as if they abandoned their cart—leaving huge orders hanging out…but then at 6:00/7:00 at night, you’d see orders start to pour in in huge surges.

We know, of course, that Black Friday and Cyber Monday aren’t over at 5:00pm local time because that’s when your business closes for the day; it’s over at 11:59pm PST. It seems that audiences are at work shopping and loading up cart, but tend to not check out until later because they’re thinking about their purchase—is it the right size, variety, etc.? Do I really want to buy this? Not to mention the checkout process can be annoying to complete while at work.

Smart remarketing tactics won’t hurt here—not creating ad fatigue, of course, but making sure people come back and complete their purchases. If you captured their contact information before they abandoned their cart, sending a gentle nudge that their cart is waiting and they’re getting a great deal can help seal the deal on conversions.

We’ll continue to watch trends throughout the holiday season and hope to have more insights to share with you on a future episode.

Thanks for tuning in! To catch future episodes of The Redirect Podcast, subscribe on SoundCloud, iTunes, or Stitcher.